The rapid development and application of AI is driving the power demand of data centers to grow exponentially.

The latest research report from Bank of America Merrill Lynch equity strategist Thomas (TJ) Thornton predicts that the power

consumption of AI workloads will grow at a compound annual growth rate of 25-33% in the next few years. The report emphasizes

that AI processing mainly relies on graphics processing units (GPUs), and the power consumption of GPUs has been rising

compared to the past.

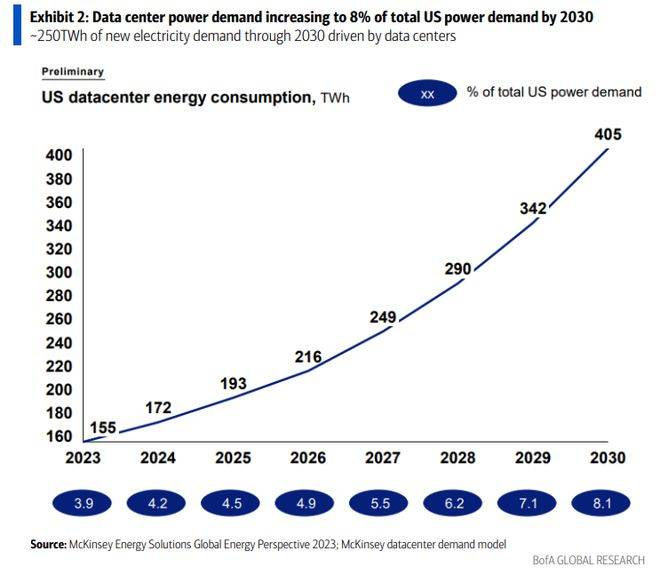

The high power consumption of data centers puts huge pressure on the power grid. According to forecasts, global data center power

demand may reach 126-152GW by 2030, with an additional power demand of approximately 250 terawatt hours (TWh) during this

period, equivalent to 8% of the total power demand in the United States in 2030.

Bank of America Merrill Lynch pointed out that the power demand of data centers under construction in the United States will

exceed 50% of the electricity consumption of existing data centers. Some people predict that within a few years after these data

centers are completed, the power consumption of data centers will double again.

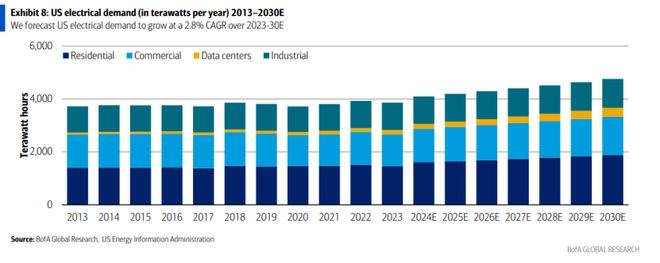

Bank of America Merrill Lynch predicts that by 2030, the compound annual growth rate of U.S. electricity demand is expected

to accelerate from 0.4% in the past decade to 2.8%.

Investment in power generation facilities further boosts demand for commodities such as copper and uranium

To meet the power needs of data centers, both grid infrastructure and power generation capacity require large-scale investment

in upgrades.

Bank of America Merrill Lynch pointed out that this will bring growth opportunities to power producers, grid equipment suppliers,

pipeline companies and grid technology providers. In addition, demand for commodities such as copper and uranium will also

benefit from this trend.

Bank of America Merrill Lynch predicts that the incremental copper demand directly brought by data centers will reach 500,000

tons in 2026, and will also boost the copper demand brought by power grid investment.

In a market of 25 million tons, (500,000) may not sound like much, but copper is essential in almost every technology that uses

electricity. Therefore, the market demand is increasing.

Bank of America Merrill Lynch pointed out that natural gas power generation is expected to become the first choice to fill the

power gap. In 2023, the United States will add 8.6GW of natural gas power generation capacity, and an additional 7.7GW will

be added in the next two years. However, it often takes four years from planning to completion of the power plant and grid connection.

In addition, nuclear power also has some room for growth. The expansion of existing nuclear power plants and the extension of

operating licenses may increase uranium demand by 10%. However, new nuclear power plants still face many challenges such

as cost and approval. Small and medium-sized modular reactors (SMRs) may be a solution, but they will not be available on a

large scale until after 2030 at the earliest.

Wind power and solar power are limited by their intermittency, and it is difficult to independently meet the 24/7 power demand

of the data center. They can only be used as part of the overall solution. Moreover, the site selection and grid connection of renewable

energy power stations also face many practical challenges.

Overall, data centers have exacerbated the difficulty of decarbonizing the power industry.

Report other highlights

The report also pointed out that data center development is moving from congested areas to areas where electricity is cheap and

easy to connect to the grid, such as the central United States that often experiences negative electricity prices due to abundant

renewable energy.

At the same time, the development of data centers in Europe and China is also showing a positive growth trend, especially China,

which is expected to become the leading country in data center manufacturing and application.

In order to improve energy efficiency, the data center industry chain is taking a multi-pronged approach: promoting the research

and development and application of high-efficiency chips, using advanced cooling technologies such as liquid cooling, and

supporting nearby renewable energy and energy storage.

However, overall, there is limited room for improvement in data center energy efficiency.

Bank of America Merrill Lynch pointed out that on the one hand, AI algorithms are progressing faster than chip energy efficiency;

on the other hand, new technologies such as 5G are constantly creating new demands for computing power. Improvements in energy

efficiency have slowed down the growth of energy consumption, but it is difficult to fundamentally reverse the trend of high energy

consumption in data centers.

Post time: Apr-22-2024