Recently, the European Commission discussed one of the hottest topics on the EU energy agenda in 2023: the design reform of the EU electricity market.

The EU executive department launched a three-week public consultation on the priority issues for the reform of the electricity market rules. The consultation

aims to provide the basis for the legislative proposal that is expected to be submitted in March.

In the months since the outbreak of the energy price crisis, the EU has been reluctant to make any changes to the EU’s electricity market, despite the severe

criticism from the southern EU member states. However, as high electricity prices continue, European Union countries have put pressure on the EU to take

action. Ursula Vondrein, President of the European Commission, announced in the 2022 State of the Union Address in September last year that “in-depth

and comprehensive” reform of power market design will be carried out.

The EU electricity market design reform aims to answer two main questions: how to protect consumers from external price shocks, and how to ensure that

investors receive long-term signals of sustainable investment in renewable energy and demand-side management. The European Union said in a brief

statement of its public consultation that “the current regulatory framework has proved insufficient to protect large industrial consumers, small and medium-sized

enterprises and households from excessive fluctuations and higher energy bills”, “any regulatory intervention in the design of the electricity market needs to

maintain and strengthen investment incentives, provide certainty and predictability for investors, and solve the economic and social problems related to high

energy prices.”

This prospect of reform forces European governments, companies, industry associations and civil society to quickly clarify their positions in this debate.

Although some EU countries are very supportive of this reform, other member countries (mainly the northern member countries) are unwilling to intervene

too much in the current operation of the market, and believe that the existing mechanism is providing a large amount of investment in renewable energy.

The energy industry itself expressed doubts and even concerns about the proposed major reform, and worried that any hasty proposal, if not properly evaluated,

might weaken investors’ confidence in the entire industry. Christian Ruby, the secretary-general of the European Electricity Company of the European Electricity

Trade Association, said, “We must avoid radical and disruptive changes because they will scare away investors. What we need is a gradual approach to keep all

parties confident in the market.”

European energy experts said that market reform needs to be conducive to attracting investment in long-term energy storage and clean energy technologies.

Matthias Buck, European director of AgoraEnergiewende, a think-tank based in Berlin, said: “We must re-evaluate whether the plan provides sufficient and

reliable long-term investment signals to fully decarbonize the European power system and meet the requirements of the European Union to accelerate climate

action.” He said: “At present, people are not talking about deepening the reform to achieve complete decarbonization of the power system, but about short-term

crisis management measures to protect consumers and households from the impact of high retail electricity prices. It is really important to distinguish between

the short and long-term debates.”

The renewable energy industry in the EU is worried that this debate is confusing the most critical issues. Naomi Chevillad, head of regulatory affairs of SolarPower

Europe, the European Solar Photovoltaic Trade Association, said, “What we really focus on is how to ensure long-term investment signals and how to make the

value of renewable energy closer to consumers.”.

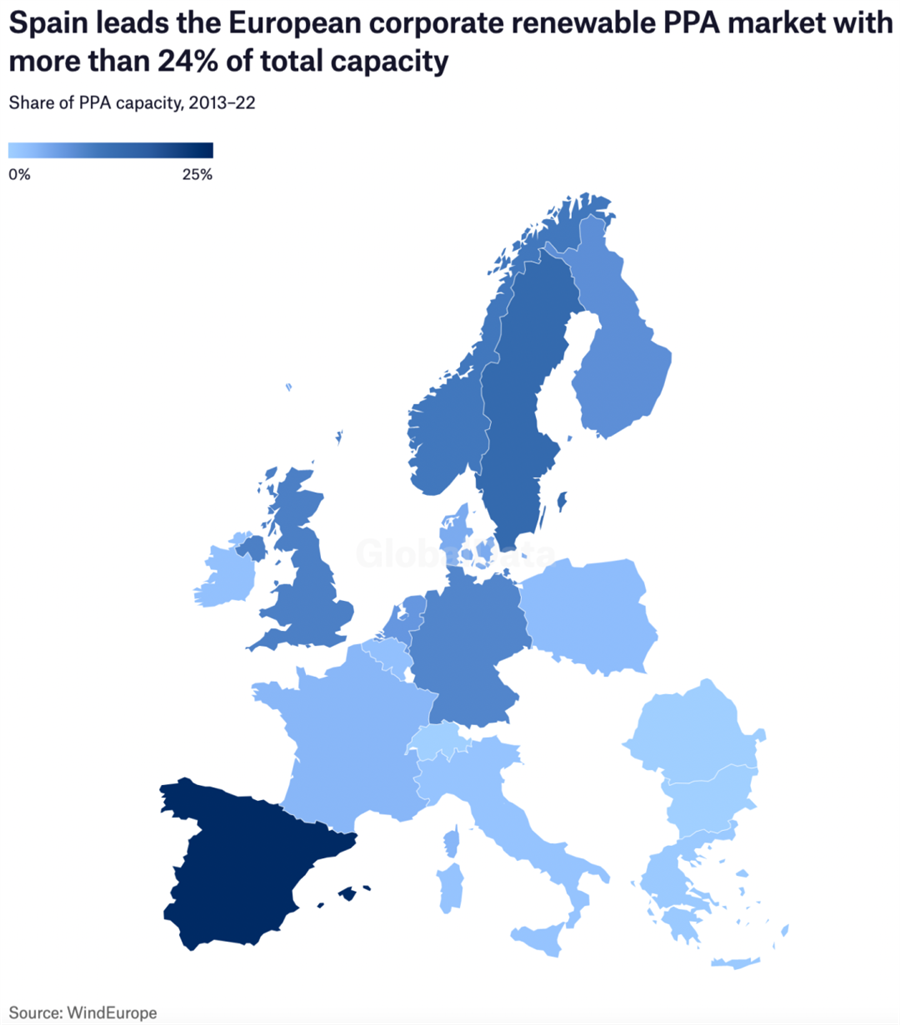

Some governments that are most in favor of the extensive reform of the EU electricity market design have expressed their support in writing. Spain attributed the

current fluctuations in energy prices to several “market failures” – it cited the shortage of natural gas supply and limited hydropower production caused by the

recent drought – and proposed a new pricing model based on long-term contractual arrangements, such as power purchase agreements (PPA) or differential

contracts (CfD). However, experts pointed out that several market failure cases referred to by Spain were all supply-side problems, and the reform of the design

of the wholesale electricity market could hardly solve these problems. Industry insiders warned that the excessive concentration of government power purchase

may pose risks, which will distort the domestic energy market.

Spain and Portugal have been hit hard by soaring natural gas prices in the past year and a half. Therefore, these two countries limit the wholesale price of

natural gas for power generation and try to control the increase of energy poverty risk.

Governments and the power industry all believe that the upcoming EU electricity market reform needs to explore how to convert the lower wholesale power

generation cost of renewable energy generation into the lower retail energy cost of end consumers. In its public consultation, the European Commission

proposed two ways: through the PPA between utilities and consumers, or through the Cfd between utilities and the government. Power purchase agreements

can bring multiple benefits: for consumers, they can provide cost-effective electricity and hedge price fluctuations. For renewable energy project developers,

power purchase agreements provide a stable source of long-term income. For the government, they provide an alternative way to deploy renewable energy

without public funds.

European consumer organizations believe that the reformed EU electricity market design has the opportunity to introduce new provisions related to consumer

rights, such as protecting vulnerable households from cutting off power supply when they cannot pay bills for a period of time, and avoiding unilateral price

increases of public utilities. The current legislation allows energy suppliers to unilaterally increase the price of electricity, but needs to notify consumers at

least 30 days in advance and allow consumers to terminate the contract for free.? However, when energy prices are high, switching to new power suppliers

may force consumers to agree to new and more expensive energy contracts. In Italy, the National Competition Authority is investigating the suspected unilateral

price increase in the fixed contracts of about 7 million households to protect consumers from the impact of the energy crisis.

Post time: Feb-06-2023